1. How do I open an account with EasyTradez?

Steps for opening account in Easy Tradez are as follows,

- Step 1: Visit our website www.easytradez.com through any internet browser and click on ‘Open An Account’ tab available at the header panel of the web page.

- Step 2: Complete the EKYC form according to the instructions mentioned in the form.

- Step 3: Once you are done with EKYC successfully a pop up will be shown on the screen which will contain a link on which you have to submit your IPV, Digital Signature and E-Signature for further process. You will also receive an Email and SMS of the link given on the popup if you want to complete with the IPV, Digital Signature and E-Signature in future.

- Step 4: POA will be delivered to you by post, which needs to be sent by you on the mentioned address within 30 days of completing your EKYC.

- Step 5: Once the UCC is shared with your registered mobile number, you can start with your trading smoothly.

2. How much time does it take to open a Demat account?

Once you submit your complete account opening form and upload all the required documents for verification, it takes about 2 hours to open an account.

3. What Are the Account Opening charges? And how will I pay them?

There is no account opening charges. Easytradez have free account opening.

4. What is in-person verification (IPV)?

IPV or In person verification as the name suggest is a process where a Depository Participant in personal verifies documents and other details as per the law by SEBI, It is Compulsory for every investor to go through the in-person verification (IPV) process before opening a trading and a DEMAT Account.

5. Do I need to sign any documents?

We are opening your account by digital signature but you need to sign the Power of Attorney (POA) document. The POA will be couriered on your registered address. If you wish to ask for a nominee, the courier will include the nominee document as well as the POA document.

6. Can I link my existing demat account with EasyTradez?

Yes, you can link your existing Demat account with EasyTradez.

7. How will I know my Trading Account has been opened?

After completion of your online registration you will receive a UCC on your registered email id. You can go for first time login & generate the login ID, password & M-Pin of your own after then you can login to your account & start trading online.

8. What if I am in college and wish to invest my pocket money, will I need my parent’s signature?

Yes, you can invest even if you are in college. However, you must be above 18 years and must have a bank account in your name.

9. What is Power of Attorney (POA)? Is it compulsory?

Power of Attorney (POA) is a legal document giving legal authority to another person to operate your account as per the instructions contained.

No, it’s not compulsory, but required for smooth operation of demat account. Remember it is required only for the demat account.

10. What kind of Accounts do I need to open for online trade?

- You need to open 2 account i.e Demat and Trading account

- DEMAT A/c :- where your demat shares will be stored

- TRADING A/c :- where the money for trade (buy and sell) will be stored.

- Both the account will be opened by us.

11. What documents should I keep handy?

Proof of Identity

This could be your Pan Card (Mandatory Id proof)/ Aadhar Card/ Driving Licence/ Passport/ Voter Id.

Note: All other Id proofs are required and considered as valid only in case where the photo on Pan card is not visible.

Proof of Address

This could be your Aadhar Card/ Driving Licence/ Passport/ Voter Id/ Bank Statement - Latest (Last 3 months)/ Bank Passbook - Latest (Last 3 months)/ Utility Bill - Latest (Last 3 months):- Electricity Bill / Landline Bill / Gas Bill.

Proof of correspondence address:

Ration card, Electricity bill, Bank passbook, Gas bill, Flat maintainance bill, Bank account statement, Telephone bill, Government employee ID card, Leave licence agreement.

Proof of Bank Account

Personalized signed cancel cheque leaf/ Bank Statement – Latest (Last 3 months)/ Bank Passbook – Latest (Last 3 months)/Bank letterhead

Proof of Derivative segment:

If you wish to trade in derivatives, you will need to provide:

Bank Statement – Last 6 Months/ Salary Slip – Latest (Last 3 months)/ Bank / IT Return – Last Year/ Form 16 – Last Year/Net-worth certificate/Copy of annual accounts.

12. What documents will be required for activating Derivative Segment?

If you wish to activate the Derivative segment, kindly send us ANYONE of the below documents :

- 1) Latest 6 months Bank Statement

- 2)Net-worth certificate

- 3) Latest ITR return

- 4) Latest Form 16

- 5) Last 3 month’s Salary Slip

- 6) Copy of annual account

13. Do I need to keep any minimum balance for running this account?

There is no specific criteria to keep minimum amount in your account. You can invest any amount as per your convenience.

14. How long does it take to activate my account for trading?

Post documents collection, they are scrutinized than the account would be activated within 2 hours.

UCC will be shared with your registered email id. You can go for first time login & generate the login ID, password & M-Pin of your own after then you can login to your account & start trading online.

15. What is 2-in-1 account?

We offer 2-in-1 account which is combination of a trading account and demat account.

2 in 1 account offers free transactions between these two accounts. This ensures that the shares are directly debited and/or credited to/from your account. No manual intervention is needed for such transaction when you have a 2-in-1 account with us.

16. What do you mean by KRA and KYC, And what is does?

Know Your Customer (KYC) is the process of verifying the identity/Physical existence of its clients.

SEBI has initiated compulsory KYC by all SEBI registered intermediaries. For this SEBI has issued the SEBI KYC Registration Agency (KRA), Regulations, 2011.

KRA – (A mandatory centralization of the KYC records in the securities market.)

The client who wish to open an account with a broker shall submit the KYC details through the KYC Registration form and supporting documents.

We will do the KYC process and upload the details on the system of the KYC Registration Agency (KRA) SEBI will access the KYC.

“Once the client has done KYC with a SEBI registered intermediary, he will not undergo the same process of filling KYC form and getting done KRA process again with another intermediary (your details will be saved by KRA and can use with the other intermediates also”.

17. Who can carry-out in-person verification?

Only the Authorized representative of the SEBI registered intermediary like EasyTradez can conduct in-person verification as part of completing your KRA-KYC compliant process.

18. My account is blocked. What do I do? / How to unblock my account?

If you have entered the wrong password thrice, your account will be locked. While entering the wrong password the fourth time, system will give you an option of forgot password. Click on‘ Forgot password’ than enter your Login ID and mobile number after than you will receive an sms with verification code on your mobile number enter that code than your account will be unblocked & active.

19. Can I have multiple DEMAT and Trading account?

Yes, you can have more than one Trading / Demat account There are no restrictions on number of accounts you have. But in one company you can open only one trading and DEMAT account.

20. Can I have multiple bank accounts linked to trading account?

Yes, you can link more than one bank account to your trading account. There are no restrictions on number of bank account you can link.

It is advisable to link all your bank account so you can transfer funds from any of your bank account and any such transfer will not be treated as third party fund transfer. It is in your interest to map all your bank account.

Here you can have more number of bank attached to your trading A/c to transfer money from saving to trading.

But you can only have a one 'primary bank' through which we will credit the amount into your account not more than 1 account, so can only link 1 primary bank to 1 trading account.

21. What are the options available to share the documents?

You can upload the images at time of EKYC ,Even though if you find any trouble uploading the images, you can send the images either through email or by writing to us at (info@easytradez.com)

1. What are the market timings?

Equity:

- 9 am to 9.15 am – Pre-market

- 9.15 am to 3.30 pm – Normal trading

- 3.40 pm to 4.00 pm – Post-market

- Note: All new IPOs are listed on the exchange at 10:00 am. The pre-open session is from 9:00 am to 10:00 am.

Currency:

- 9 am to 5 pm – Normal trading

2. What are pre market and post market sessions and orders?

- Pre - Open: NSE started the concept of the pre-open session to minimize the volatility of securities during the market open every day. Between 9:00 AM to 9:15 AM is when the pre-market session is conducted on NSE

- During the pre-market session for the first 8 minutes (between 9:00 AM and 9:08 AM) orders are collected, modified or cancelled. You can place limit orders/market orders. After 9.08 AM to 9.15 AM no new orders can be placed, orders placed are matched and trades confirmed. So technically you can place orders only for the first 8 minutes and only on equity segment.

- Post - Open: Similar to pre-market orders, post-market orders are allowed only for equity trading. The post-market session or closing session is open from 3:40 PM to 4:00 PM.

- During this session, people can place buy/sell orders in equity (delivery segment using the CNC product code) at the market price but do note that even if you place a market order it will be placed on the exchange at the closing price.

- So for example, if the closing price of SBIN at 3:30 PM is Rs. 300, between 3:40 PM and 4:00 PM, you can place market orders to buy/sell SBIN at market price (will be taken at Rs. 300). The post-market session is not very active and you can look at the movement of stocks by opening the Marketwatch window from 3:40 PM to 4:00 PM.

3. I’ve bought shares but its not showing up in my holdings, why?

- The following are the reasons why you may not be seeing the shares you’ve purchased:

- A. The shares that you have bought have been short delivered.

- The seller of the shares has defaulted on the settlement of shares. Short delivery is an event where the seller of the shares, defaults on the delivery of the shares by T+2 Days. In such cases, the exchange holds an auction for the same quantity of shares & delivers it to the buyer.

- Short delivery can happen in stocks with less liquidity, or if a short MIS hasn’t been squared off in some circumstances.

- In this case, you will be notified of the same via SMS and email.

- B. If you have a 'trade to trade' stock in your holding and you sell it, but buy it back it on the same day, the stocks will not be visible in your holdings till after the settlement (T+2 days).

4. What does normal settlement mean?

- The normal settlement cycle for a transaction on the exchange is T+2 days, i.e if you buy a share it will take 2 days for it to be credited to your DEMAT account. (Also implies that if you sell shares you will be able to withdraw that amount after T+2 days)

- Ex- if you buy a share on Monday, it’ll be credited to your account on Wednesday evening. (If you sell shares on Monday it'll be withdrawable on Wednesday)

- The settlement cycle for Derivatives (F&O, MCX) is T+1 day.

- Note: On settlement holidays since the Depositories and clearing members are closed, the settlement duration get extended & stocks bought a day before the settlement holidays will not show up on the trading platform.

5. I’m not able to buy a stock on EASYTRADEZ even though its trading on the exchange?

- If you’re facing the above issue, you have to check which series/group the stock is trading in by checking on NSE or BSE website.

- This issue occurs when a particular scrip has been moved from one series to another and an order is placed in the series the stock was moved from and you’d generally get the error.

- For Ex - if Apex Frozen Foods was moved from BE series to EQ - and is trading as a stock in the EQ series.This can be verified by checking on the NSE website under the ‘series’ header.

- If you place an order in APEX-BE from the trading terminal, the order will get rejected. This can be resolved by placing the order in the current series under which the stock is trading, which in this example would be APEX-EQ which is shown as just APEX in the market watch.

6. What do the different groups on NSE and BSE mean?

NSE & BSE categorize stocks based on what they represent, where each series/group represents a different category of stocks, distinguishing them from each other and also the people who can trade them.

7. Why do Futures & Option scrips enter ban period, what does it mean?

- For any security, if its derivative contracts cross 95% of Market wide position limits (MWPL) then that security will be under the ban for F&O.

- It means the combined open interest [the number of contracts outstanding in futures and options trading on an official exchange at any one time.] of all option and future contracts for all the months taken together for that particular underlying crosses 95% of MWPL.

- A user isn't allowed to open any new positions in securities under ban period but can exit already opened positions.

8. What does circuit limits i.e price bands mean?

- These are safeguards set to prevent large moves in the stock in a very short time and when the price changes above or below the limit, trading is halted on the stock. The price band is the range within which the scrip can be traded without being halted.

- Orders placed out of the price band will be rejected, and if the price drops to the upper/lower price band trading will temporarily be halted. F&O stocks have dynamic price bands in order to prevent erroneous order placement.

9. How do I rollover a F&O position in ban period?

To rollover contracts in ban period, you will have to call up the dealer desk.

10. What are Open interest limits?

- In addition to adhering to the exchange mandated initial margin requirements, brokers are also subject to position limits. Open Interest (OI) is a number that tells you how many futures (or Options) contracts are currently outstanding (open) in the market.

- There is a client-wise open interest limit of 5% of total number of all derivative contracts for the same underlying and a 15% open interest limitation for the trading members (brokers)

11. What does De-listing of a stock mean?

- The term "delisting" of securities means removal of securities of a listed company from a stock exchange. As a consequence of delisting, the securities of that company would no longer be traded at that stock exchange. These stocks won't be visible on the EASYTRADEZ

- A company delists for 2 reasons - forced or voluntarily.

- Forced delist - This is when the exchanges decide to delist the company, usually for non-compliance. If you are holding shares of such companies, then you will have to write it off as bad investment.

- Voluntarily delist - This is when the company itself decides to delist the shares from the exchange. This could be an outcome of a corporate restructuring exercise. Under such a situation, the company has to offer a premium over and above the current market price of the shares. Usually, the premium shoots up to 30-40% or more.

- Either way, when delists, the shares are relinquished and is no longer traded in the markets.

12. Why is my order not getting executed even though its been placed successfully?

- In certain situations, where there is extremely bad news regarding the company, the stock prices drop rapidly. Due to this, the stock hits lower circuit limits continuously on a daily basis and no new people come in to buy these shares. This generally happens in penny stocks which have no liquidity.

- Similarly, when there is a lot of buying pressure & demand for a certain stock, there may be a lot of bids but no one willing to sell these shares.

- The market depth will look as depicted in the below images -

13. What is the impact of Corporate actions on futures and options?

- Corporate actions like Bonus, Rights, Extra-ordinary dividends, Merger/Demerger, Amalgamation, Splits and Consolidations will result in adjustments in the futures & options contracts of the underlying stock which is undergoing the corporate action.

- The basis for any adjustment for corporate actions shall be such that the value of the position of the market participants, on the cum and ex-dates for the corporate action, shall continue to remain the same as far as possible.

- Adjustments will result in a change of base price, option strike values & the market lot depending on the adjustment factor. In a lot of cases, adjustments may result in the change in date of expiry of the contract as well i.e contract will be force closed before the expiry date and the adjusted contracts will trade instead.

- The adjustments would be carried out on any or all of the above, based on the nature of the corporate action. The adjustments for corporate actions would be carried out on all open positions.

14. What does the different types of flag mean in activity log?

1. Confirm-

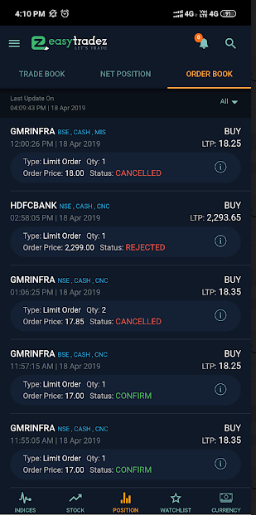

An order that's been received, approved by the exchange and routed for execution.

2. Completed-

An order that's been completed. You can find out the trade price, time of the transaction, number of shares bought or sold and other trade details from activity log and trade book page

3. Modified-

Order is modified. Client can modify only pending orders. Executed orders can not be modified

4. Cancelled-

Your order is cancelled and is no longer working at the exchange. No modifications or cancellations can be made after an order has been cancelled.

5. Rejected

Your order was rejected. Rejections can occur for a number of reasons and you can view order details to see the specific rejection reason by right-clicking the order in the Orders module and selecting Order Details.

6. Partial

When order is completed partially then it will show as partial in activity log. Partial order can be modified from order book page.

15. What does the different types of error flag mean in order book?

1. Placed

Orders are not reaching to the exchange from the API server. Then it will come as placed in order book. To report the issue call to our customer service.

2. Inprocess

If order processor is not on then in order book inprocess will come. To report the issue call to our customer service.

16. Why is my order getting rejected?

If a buy or sell order you have placed is rejected it could be due to one of many reasons like insufficient margin, incorrect use of order type, scrip not available for trading, stock group change etc.

1.ERROR- CNC LIMIT EXCEEDED

Reason-

Required limit is not there in the account

2.ERROR-Price is not in a given range

Reason-

Upper and lower circuit might be changed by exchange due to high volatility and new ckt limit is not updated). Call our customer service to update the ckt limit.

3.ERROR- Order does not exist

Reason-

Traded in wrong named scrip which does not exist

4.ERROR- Security is not allowed to trade in this market

Reason-

Placing order before premarket and after market close

5.TRANSACTION NOT ALLOWED IN CURRENT INSTRUMENT STATE [CLOSED]

Reason-

Market is not open

6.ERROR- MIS orders acceptance disabled by admin

Reason-

Mis order is not allowed after 3.10

17. Can I buy and sell shares across the two exchanges?

- You will be able to place an MIS buy order in one exchange and an MIS short order in the other. You will not be able to do the same using CNC for intraday trades.

- You will be able to buy in one exchange and sell in the other after you get delivery for the shares i.e T+2 days.

18. How do I verify the trades I’ve taken at the exchange?

- All the trades that you make on our terminals can be re-confirmed on the respective exchanges within 5 days from when it was executed.

- For NSE - NSE Trade verification module

- For BSE - BSE Trade Check

19. Are NRIs taxed on their income earned in India?

- As per provisions of Section 5 of the Income Tax Act,1961, income received in India is chargeable to tax.

- It is recommended that you consult a tax expert who will help you based on the nature and quantum of your income earned in India, will calculate your tax liability.

20. Why did my order get executed at different price points?

- When you place a market order, the order will get executed at the best bid/offer available at the exchange. If the quantity of the existing bids/offers isn't enough to match your order quantity, in that case, the remaining unexecuted quantity will be matched against the next best bid/offer.

- Let's us understand this using an example:

- Below is the market depth of GMRINFRA, let's assume you place a market order to buy 100 shares, 20 shares will get purchased at Rs.15 , 50 shares will get purchased at Rs.15.50 and the remaining 30 shares will be purchased at Rs. 15.75 .

- The same concept applies to limit orders in a different way. In the above example if you had placed a limit order to buy the 100 shares at Rs.15 , then 20 shares would be bought immediately but the remaining shares 80 quantity will stay as a pending order in your order book, and subsequently, if any offer at your price comes in, the order will be executed.

- Note: If any of the bids/offers have the disclosed quantity only, in that case, the quantity executed will be different from that seen in the market depth.

21. Why do I get an SMS and email from NSE, BSE when I trade?

In a move to check unauthorized stock market trades through investor accounts, NSE and BSE send SMS/Email alerts to retail investors for their transactions on days they have traded.

22. Can I do an arbitrage trade between the two exchanges?

This can be explained with an example:

Assume Reliance stock is trading on NSE at 1000 and on BSE at 1004, you can do an arbitrage trade for intraday, so you can buy on NSE at 1000 and short on BSE at 1004, when the price difference comes lower than 4 (1004-1000) sell on NSE and buy back the shares on BSE. When you cover, if the difference between NSE and BSE prices is lesser than 4 you make a profit, if not, losses.

This is an arbitrage trade because it doesn’t matter to you if reliance goes up or down, all you are bothered is about the price difference between Reliance on NSE and BSE.

You can also do such a trade if you already have stocks in your DEMAT. So for example, if you held Reliance in your DEMAT, you could sell it at 1004 on BSE and immediately buy it on NSE for 1000, this way to reduce the cost of your holding.

What you cannot do is - delivery based arbitrage, i.e buying on NSE and Selling on BSE without holding the stock in your DEMAT account. (CNC orders).

Assume you buy reliance stock on NSE at Rs 1000, the delivery of this stock will come to you only on Wednesday evening (T+2 day), whereas the stock you sold on BSE at 1004, you will have to give delivery of that to the exchange latest by Wednesday morning (T+2).

But until evening you will not have reliance shares, so on Wednesday morning you will end up with a short delivery and will be taken to auction which can have huge implications in terms of penalty, where you can lose much more than the Rs 4 arbitrage profit you were trying to put the trade for.

23. What are Bid Price and Ask Price?

When you sell a stock, the price received for that, is the bid price. When you plan to purchase a stock, the price you get for it is the ask price

24. What does Last Traded Price (LTP) mean?

The last traded price is simply the last buy / sale price of a particular security. It is also known as “Current Market Price”.

25. What are the platforms available for Trading?

- EasyTradez is having two platform to trade viz.

- 1. Website EasyTradez.com

- 2. Easytradez App

26. What are the different products available for trading?

- Equity

- Equity derivative

- Currency derivative

27. Can I start trading as soon as my account is opened?

- Yes, you can start trading as soon as your trading and demat a/c is been opened. But please take care of the following condition's.

- IPV & POA should be done within one month or else after 1 month it may put you in trouble while trading.

28. Can I trade after markets are closed?

- Yes you can through the mode of, After-market Orders (AMO), but some of the conditions will be applied.

- After market order

- SECURITIES

- Currency Derivatives 4:00 PM - 8:59 AM

- F&O Till 9:10

- Equity 4:00 PM - 8:59 AM

- Commodity anytime at 10:00 AM (MCX opening)

- Conditions :-

- For currency equity F&O – Currency If you place any after-market order between 9:15 AM and 4:00 PM, they could all be cancelled by 4:00 PM !

- Commodity - if you place an after market order at 9:59 it will get sent today and if you place it at 10:01 it’ll get sent tomorrow !

29. What does Intraday and Delivery mean?

- Intraday :- When you buy and sell a stock within the same day, it is called Intraday Trading.

- Delivery :- If we buy shares today and sell them after 1 day then the type of trading is called as Delivery Trading or before the expiry date.

30. What is Day & IOC validity type?

- Day Type Order :- A day order is an order to buy or sell a security that automatically expires if not executed on the day the order was placed.

- IOC :- An immediate or cancel order (IOC) is an order to buy or sell a security that must be executed immediately, and any portion of the order that cannot be immediately filled is cancelled

31. What are Regular and AMO orders?

- Regular Orders :- Are those order which you place in regular stock market trading hours

- AMO :- Where you can place the order after the stock market closes of before market opens from 3:45 PM to 8:57 AM for NSE & 3:45 to 8:59 AM for BSE

32. What is Market Depth?

Market depth is the market's ability to sustain relatively large market orders without impacting the price of the security. Market depth considers the overall level and breadth of open orders and usually refers to trading within an individual security

33. What is MIS Order and what are its uses?

1. MIS (Margin Intraday Square off ) :- your order will remain activated till that particular day

Uses :- Advantage of margin when you use MIS you need to pay only some amount or % of stock.

34. What is CNC order and what are its uses?

- The full form of CNC is Cash & Carry it is a non-intraday product used in the Equity Segment of BSE & NSE. It is used for buying or selling shares for delivery. The shares purchased using the CNC option would be transferred to your demat account after T + 2 days and shares sold using the CNC option would be transferred from your demat account to fulfil your sale obligations with the exchanges. For example, if one wishes to buy shares of a company and sell it after a few days, one should use the CNC as the product type.

- Uses :- Use this order type when you want to take delivery of particular stock or carry your position overnight.

35. What is NRML order and what are its uses?

- NRML is used for overnight trading of futures and options. If the client does not want any excess leverage, he can use the product type NRML, and he would not have to worry about auto square-offs. NRML product code is also used for Delivery based trading of Currency.

- Uses :- NRML order type when you buy or sell a future contract and want to carry around overnight or until expiry of that contract.

36. What does Last Traded Price (LTP) mean?

The last traded price is simply the last price that a trade occurred in a futures contract.

37. Does EasyTradez offer automated trading (algorithmic trading) for retail investors in India?

No; EasyTradez doesn't offer automated trading to its retail trading customers.

38. How do I see my portfolio?

Once you have logged in, you will find Menu bar .Click on menu bar in that their are various options click on portfolio under that you can check your holdings

39. What are the segments and exchanges offered by EasyTradez ?

We are trading on multiple segments

NSE - Equity Cash Segment (CM)

NSE - Equity Futures and Options Segment (F&O)

NSE - Currency Futures and Options Segment (CDS)

BSE - Equity Cash Segment (CM)

BSE - Equity Futures and Options Segment (F&O)

BSE - Currency Futures and Options Segment (CDS)

Please note:

Customer has to select at least 1 trading segment while opening the account.

The trading segments can be changed at any point of time. A form for adding or removing -trading segment should be filled, signed and couriered to our office.

40. What are the instruments can I invest in?

- With your Easytradez Trading Account, you will be able to invest in equity and derivatives.

- Note: This will depend on the segments you have opted for at the time of opening your Trading Account.

41. What do the different group on BSE mean?

BSE categorizes the Equity segment into 'A', 'B', 'T' & 'Z' categories where:

- * The A group contains the list of the most popular stocks. Stocks that are actively traded.

- * The Z group consists of Equity stocks which are blacklisted for not following Exchange rules & regulations or has pending investor complaints or any such reason.

- * The T group consists of stocks that form part of the Trade to trade segment. Trade to Trade segment is a segment in which no intraday trading is allowed. All trades result in delivery.

- * The B category includes stocks which don't form part of any of the above Equity groups.

- * Additionally BSE also has the F group which denotes the Debt market segment.

- * M/MT group consist of stocks forming part of BSE's SME (Small & Medium enterprise)

- * G group consists of Government securities available for retail investors.

- * I group consists of Interest rate underlying.

- * E group consisting of ETF's (Exchange Traded Funds)

42. What do the different series on NSE means?

NSE consist of series viz.

EQ: It stands for Equity. In this series intraday trading is possible in addition to delivery.

BE: It stands for Book Entry. Shares falling in the Trade-to-Trade or T-segment are traded in this series and no intraday is allowed. This means trades can only be settled by accepting or giving the delivery of shares.

BL: This series is for facilitating block deals. Block deal is a trade, with a minimum quantity of 5 lakh shares or minimum value of Rs. 5 crore, executed through a single transaction, on the special “Block Deal window”.

The window is opened for only 35 minutes in the morning from 9:15 to 9:50AM.

BT: This series provides an exit route to small investors having shares in the physical form with a cap of maximum 500 shares.

GC – This series allows Government Securities and Treasury Bills to be traded under this category.

IL – This series allows only FIIs to trade among themselves. Permissible only in those securities where maximum permissible limit for FIIs is not breached.

1. What is Watchlist?

market watch is the screen where you can add items from stocks/commodities/F&O/currencies and track live prices of the same. You can use these market watchlists to monitor specific stocks that you are interested in, across different sectors and industries.

2. How to create new Watchlist in Easytradez mobile app?

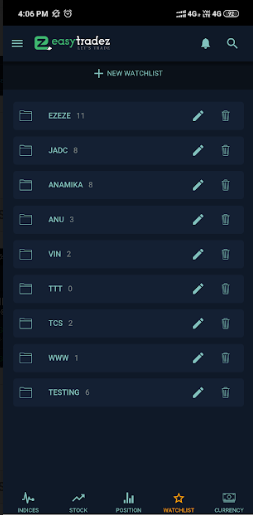

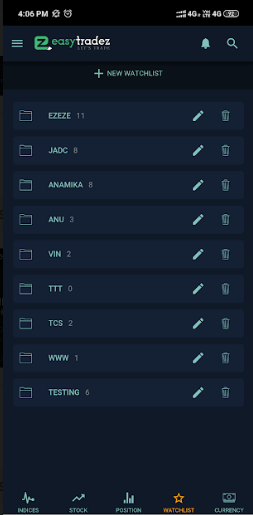

- Step 1 : To create a new watchlist, click on “+New Watchlist”. The screen looks as the image below:

- Step 2: Type the name of the Watchlist and click on Done button. This will add your new watchlist

3. How to delete the Watchlist from Easytradez mobile app?

- You can delete the watchlist by clicking the delete icon next to it.

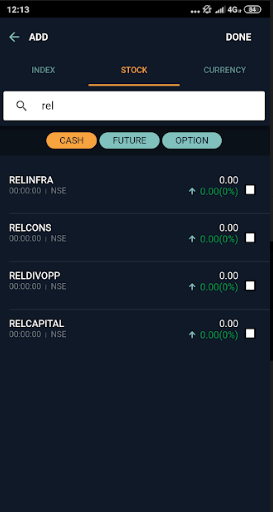

4. How to add the scrips in the watchlist?

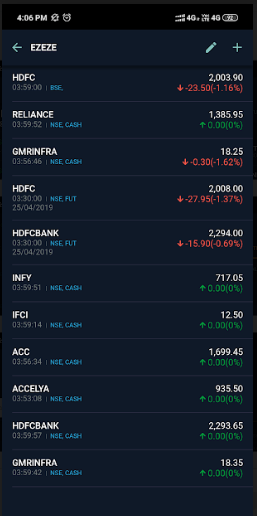

- Click on the watchlist in which you want to add the scrips and the click on the “+” button to add the new scrips.

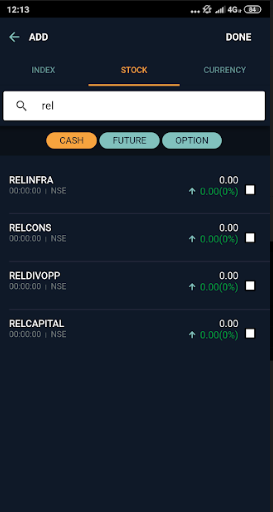

- In the next page you will find three options – index, stock and currency. Click on one of them and write the name of the stock in the search bar. Select the stocks you wish to add.

- For example, to add the Tatacoffee scrip, click on Stock in the header panel , then click Cash. Type the scrip name, then select the Tatacoffee scrip and click on done button.

- Refer the below image

5. How to delete the scrips from the watchlist?

- To delete the individual scrip from your watchlist click on edit icon shown in the image below:

6. How to buy/sell from Easytradez app?

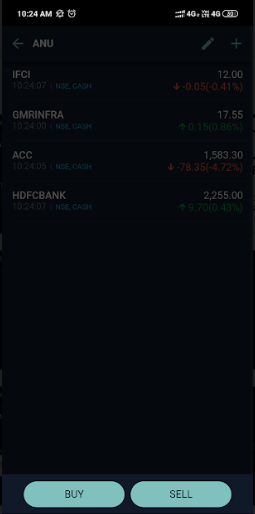

- You can buy or sell scrips from your watchlists.

- Long tap on a scrips which will open up the buy and sell pop-up as shown in the image below. Click on buy/sell and you will be directed to the order placement page.

- Short clicking on the scrip, will lead you to the scrip detail window where you can select the exchange in which you wish to buy and on clicking buy and sell button from this window, you will be directed to the order placement page This page gives you information about the Market Depth and Statistics of the Scrip.

- You can also buy and sell scrips from the trade book and net position.

- Order Placement Page

- By clicking on the D form the trade page the user can go to the market depth of the scrip.

7. What does margin available and margin used mean?

- When it comes to Funds in your trading platform, the total account value is the closing balance of the previous day's ledger, brought forward.

- Margin Used :- The net funds utilized for equity intraday, F&O positional /intraday trading & delivery trades. Whenever you sell your shares, open F&O positions or if you’ve made profits intraday the margin used will be negative.

- Whenever you square off your positions margin used will be credited back to Margin available. Margin available is the amount available for you take further positions.

- For example, If margin available is 100000 & margin used is 50000 then the total amount value will be 150000

- If you have not added money on a particular trade date and have traded, then the Total Account Value = Margin Available + Margin Used.

8. What is span and exposure margin?

- SPAN Margin is the minimum requisite margins blocked for futures and option writing positions as per the exchange’s mandate and ‘Exposure Margin’ is the margin blocked over and above the SPAN to cushion for any MTM losses.

- Do note both SPAN and Exposure margin are specified by the exchange. So at the time of initiating a futures trade, the client has to adhere to the initial margin requirement. The entire initial margin (SPAN + Exposure + ADHOC margin) is blocked by the exchange.

- Note: From 2nd July 2018 onwards, SEBI has made it mandatory for both SPAN and exposure margin to be blocked in order to take an over night position. If it isn't, margin penalty will be applicable.

9. What is disclosed quantity feature and how to use it?

Disclosed quantity allows you to disclose only a part of the actual quantity you want to buy/sell. Once the disclosed quantity is specified by the client, the order is sent to the exchange and only the disclosed quantity will be shown on the market screen.

The disclosed quantity, if entered should not be greater than order quantity and should also not be less than 10% of the order quantity.

Eg: If the customer wants to buy/sell 25000 shares, with a disclosed quantity condition of 5000 shares, only 5000 shares will be displayed to the market at a time. After this is traded, another 5000 shares will be automatically released until the order is fully executed.

Disclosed quantity can’t be used when we trade in futures & options.

Different exchanges have different disclosed quantities:

- NSE/BSE (Equity) = Disclosed quantity cannot be less than 10% of your order.

- NSE/BSE(F&O) = There is no disclosed quantity option. You can place multiple orders if you want to buy/sell huge quantity without shaking up the market.

10. What is the market depth screen and how do I view it?

- The market depth screen is where you can see the best 5 bids and offers/asks for a particular instrument.

- The dynamic market depth bars give you a visual overview of what levels most orders are being placed and you can place an order at any price in the depth with a click on it.

11. What is IOC orders?

- IOC (Immediate or Cancelled) allows a user to buy or sell a security as soon as the order is released into the market, failing which the order will be removed from the market.

- Partial match is possible for the order, and the unmatched portion of the order is cancelled immediately. IOC orders are only used when placing orders in very large quantities.

- When IOC orders don't get matched, then it comes as “Cancelled” in activity log and order book

12. What is Collateral Margin?

- The collateral margin is the margin received against pledged stocks after the haircut deduction.

- Collateral margins can be used to trade futures, and sell options.

- If you’ve pledged stocks, you’ll be able to see the collateral margin under the funds tab on Easytradez app.

13. Where can I see my pending orders?

Order book shows pending orders.Access the order book by clicking on portfolio icon on the footer panel.

14. Where can I see executed order?

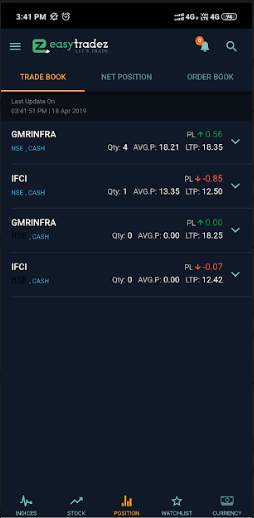

Trade book shows all your executed orders. View trade book by clicking on “Portfolio” icon on the footer panel.

By clicking on the arrow the user can see the trade details.

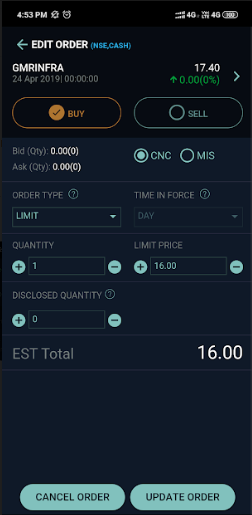

15. How to modify and cancel my orders?

Modify or cancel pending orders by tapping on particular order in the order book.

The below screen appears where you can either modify your order, by creating a modification in any of the order fields, or cancel the order.

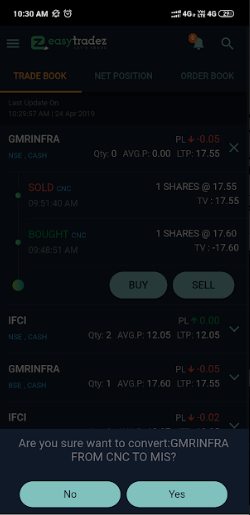

16. How to convert my shares MIS/CNC to CNC/MIS?

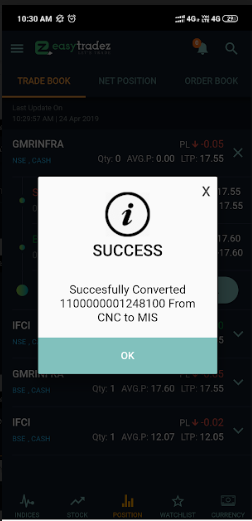

From the trade book you will have to click on the details of the scrip and a popup will appear on the screen for conversion of the scrip. Refer to the image below:

1. Can I transfer funds from my trading account?

Yes, you can transfer fund from your trading account to bank account.

2. How to transfer fund from bank account to trading account from Easytradez App?

To transfer fund from bank account to trading account click on the funds in menu bar. Then click on ADD FUNDS option in the footer.

3. How to withdraw fund from Easytradez?

To Withdraw funds from Easytradez click on the funds in menu bar. Then click on WITHDRAW option in the footer.

4. How long does it take for funds to reflect in my bank account?

It will take T+ 1 day for funds to reflect in your account.

5. How do I link my existing Demat account?

You can link your existing Demat account with the KYC process.

6. How do I link multiple bank accounts in my existing EasyTradez Account?

Yes, you can link multiple bank accounts to your trading account

First download the modification form from our website fill it and courier it with bank statement to our office.

7. How much amount can i withdraw from my account ?

There is no limit to withdraw money from your account but make sure that you have enough money in your trading account to trade further.

8. Can I withdraw money from my trading account ?

No, you can’t withdraw money from trading account when your money will be transferred from trading account to saving account than only your exchange money/profit kept in trading account you can transfer.

9. What is the process of transferring money from trading to saving account ?

First you need to send the request of fund transfer with desired amount from trading to saving.

After than we will accept the request and transfer the fund from trading to saving account.

10. Is there a limit for fund transfer ?

- No, there is no limit for fund transfer,

- from Saving to trading :- as much as fund you want you can transfer.

- from Trading to Saving :- As per your desired amount request you send to us for transfer fund.

- Caution :- ! While transfer fund from “ Trading to Saving” make sure you have enough funds in trading account so you can trade further !

11. Can I transfer my fund to trading account with en-number of banks?

Yes, you can transfer money/fund from saving account to trading account with different banks

12. How much time it will take to transfer money from saving to trading account?

- If you use RTGS/NEFT it may take 4-5 hours.

- If you use Instant fund transfer it takes 2-3 minutes

- But we can only transfer fund from Trading to Saving account to your “one primary” bank link to your account.

13. How to check the status of the funds that I have transferred to my trading account?

- To check the status of your Fund Transfer

- Go to menu bar, then click on Account summary

- Then tap on today’s available balance and check your intraday payin.

14. How do I check my account Ledger?

To check the Ledger, follow below steps:

- Login to your account and go to Menu bar

- Click on Back office report & click on financial Balance